Simon Johnson on Bill Moyers Journalhttp://www.pbs.org/moyers/journal/02132009/watch.htmlBILL MOYERS: Are you saying that the banking industry trumps the president, the Congress and the American government when it comes to this issue so crucial to the survival of American democracy?

SIMON JOHNSON: I don't know. I hope they don't trump it. But the signs that I see this week, the body language, the words, the op-eds, the testimony, the way they're treated by certain Congressional committees, it makes me feel very worried.

...

BILL MOYERS: ...I mean, when I watched the eight CEOs testify before Congress at the House Financial Services Committee earlier this week, I had just finished reading a report that almost every member of that Committee had received contributions from those banks last year. I mean in a way that's like paying the cop on the beat not to arrest you, right?

...

SIMON JOHNSON: I have no problem with poachers turning gamekeeper, right? So if you know where the bodies are buried maybe you can help us sort out the problem...

...

SIMON JOHNSON: I have no idea. Of course, the administration, the new administration, has a lot of rules about lobbying. And they have rules that basically say, I think, as understood the rules, when they were first presented, I was very impressed. They basically said, "We're not going to hire lobbyists into the administration. There has to be some sort of cooling off period."

BILL MOYERS: And the next day Obama exempted a number of people from that very rule that he had just proclaimed.

SIMON JOHNSON: Yes. It's a problem. It's a huge problem.

BILL MOYERS: So here's the trillion dollar question that I take from your blog, that I read at the beginning, quote, "Can this person," your new economic strategist, in this case Geithner, "really break with the vested elite that got you into this much trouble?" Have you seen any evidence this week that he's going to be tough with these guys?

SIMON JOHNSON: I'm trying to be positive. I'm trying to be supportive. I like the administration. I voted for the president. The answer to your question is, no, I haven't seen anything. But you know, perhaps next week I will. But right now, as we speak, I have a bad feeling in my stomach.

My intuition, from crises, from situations that have improved, the situations that got worse, my intuition is that this is going to get a lot worse. It's going to cost us a lot more money. And we are going down a long, dark, blind alley.

...

SIMON JOHNSON: That's where you go and you check the bank's books, and you say, okay, not only do we use market prices, not pretend prices, not what you wished things were worth, what they're really worth, okay, in the market today. We use that to value your loans and the securities that you have, your assets, right?

And we also assess what will happen to the value of the things you own if there's a severe recession. So that's the idea, it's a stress test, like when you go to see the doctor, they put you on a treadmill, and make you run to see how your heart is going to behave under stress.

So you're looking at how the bank's balance sheets will look under stress. And then you say to them, "This is our assessment of the amount of capital you need to cover your losses, and to stay in business, and be able to make loans, through what appears to be a severe recession."

And, as the president said, we may lose a decade. So we've got to be very hard headed, and all the officials forecasters are still too optimistic on that. This is the amount of capital you need. Now you have a month, or two, to raise this amount of capital privately.

And when this was done in Sweden, by the way, in the early 1990s, they did it to three big banks. One of the three was able to go to its shareholders, raise a lot more capital, and stay in business as a private bank, same shareholders. That's an option. Totally fine. However, the ones that can't raise the capital are in violation of the terms of their banking license, if you like.

We have no problem in this country shutting down small banks. In fact, the FDIC is world class at shutting down and managing the handover of deposits, for example, from small banks. They managed IndyMac, the closure of IndyMac, beautifully. People didn't lose touch with their money for even a moment. But they can't do it to big banks, because they don't have the political power. Nobody has the political will to do it.

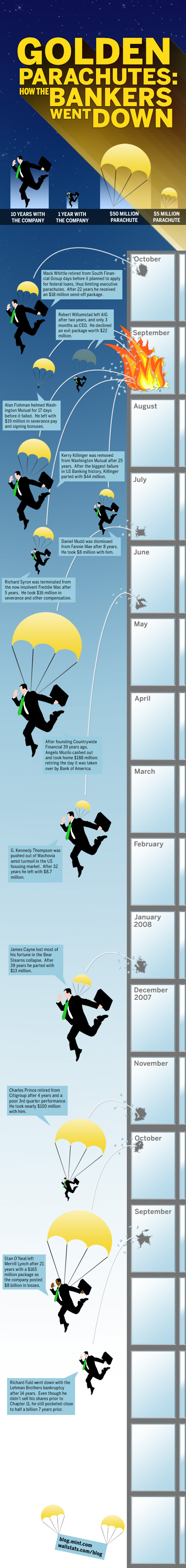

So you need to take an FDIC-type process. You scale it up. You say, "You haven't raised the capital privately. The government is taking over your bank. You guys are out of business. Your bonuses are wiped out. Your golden parachutes are gone." Okay? Because the bank has failed.

This is a government-supervised bankruptcy process. It's called, in the terminology of the business, it's called an intervention. The bank is intervened. You don't go into Chapter 11 because in that's too messy. Too complicated. There's an intervention, you lose the right to operate as a bank. The FDIC takes you over. I think we agree, everyone agrees, we don't want the government to run banks in this country.

------

Here's what I want to be understood in the most crystal clear way that is possible to imagine: we know exactly what to do and we must do it.

I've been blathering on about the solution for over two months privately and I even blogged about it here:

http://thebloodofpatriotsandtyrants.blogspot.com/2008/12/what-should-have-happened.html

There is no fucking mystery in what we need to do. None. Zero. Anyone that tries to claim that we don't know what to do is completely and hopelessly full of shit. Got that?

Most reasonable economists agree that we need to do something like the Swedish solution. Krugman supports it. DeLong supports it. The list is quite expansive really. Those people are not idiots despite what people may say about their political leanings. And despite all the empty rhetoric about how "left-leaning" these economists may be let's be clear about what they want to do: they want to save capitalism and the status quo in this country as you know it. For this they are branded heretics, leftists, and even socialists.

The extreme right - completely blinkered and as spent as a used condom - wants more deregulation and tax cuts to boot. The market will correct this problem. I really can't address that kind of thinking because it is too cruel and asinine on its face. Thousands will die while these morons figure out that they are dead fucking wrong.

Personally, I am extremely disappointed in Obama already. It may be that he is in the midst of the ultimate clever economic brinksmanship against the GOP...maybe...we can hope. Hope is cheap. Hope is usually in vain and achieves nothing. Or it may simply turn out that despite all of that uplifting campaign rhetoric Obama is a mere stooge for the elites that control him.

We are in deep shit. Not because the outlook is so bad economically, but because there is no political will or ability to do what must be done.

We are in the grip of the lootocracy.